You’ve seen it. I know you have. Either on Facebook, Twitter, Pinterest, Instagram etc, you’ve seen some variation of the 52 Week Money Saving Challenge. Everybody is doing it & I bet you’re thinking about it too – except I’m about to burst the bubble & tell you why you SHOULD NOT do it (not their way, anyways).

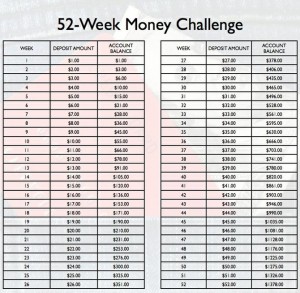

It seems every year, right around New Years, this popular post begins winding it’s way around the internet gaining popularity. The basic premise is great – I’m all for saving money! The challenge is to save an increasing incremental amout of money each week starting with $1 on week 1 and ending with $52 on week 52. At the end of the 52 weeks (1 year) you will have saved $1378. YAY! You begin by printing off the “Saving Schedule” and afixing it to a jar or some sort of container where you put your money.

However, there are some majors flaw in the system.

I still recommend doing the challenge, but do it this way instead

Flip the Schedule and Save DECREASING Amounts Each Week

That’s right – flip that savings schedule right on it’s head! Start at week 52 and work your way backwards. There are 2 major reasons for this:

1. Get the hard work done first – In the original method, you have to save $52 the very last week of the year. I don’t know about you, but after all of my Christmas shopping, holiday parties & planning, etc are done – finding an extra $52 in my bank account is easier said than done. If you get the biggest contribution out of the way first, it makes every one after that a little easier. And by December, when your dollar is stretched the tightest, you only need to contribute an extra $10 for the whole month and still make your goal!

2. Immediate results – If you follow the reverse 52 week schedule, you will have already saved a whopping $202 by the end of January versus the original plan which only nets you $10 in the same time frame. Immediate results boost motivation and seeing the balance climb should keep you in the saving spirit!

Don’t Do The Jar

I repeat – Don’t Do The Jar. I know it sounds like a great idea to have the money you’re saving right in front of you so you can see the progress but it’s a BAD idea. Trust me. You may have the best of intentions right now, but there will be a day down the road where you’ll think “Oh I’ll just grab $5 out of the jar for lunch and replace it tomorrow.” One little grab out of the jar will turn into 2 and 4 and so on. There goes all your savings.

Instead, open a separate savings account with your financial institution. For Royal Bank users, I strongly recommend the High Interest E-savings account. This account is free to open and maintain and provides the BEST chance of keeping your money safe. Not only is this account not accessible via your debit card (no “accidental” spending slips), it will actually earn you MORE money in interest! It may not be much but it still is more than you would’ve got with your money in a jar, am I right?!? If you aren’t with RBC, ask your bank about similar options.

Set a Goal

Make that money mean something. Saving money just to save money doesn’t sound all that exciting (even though you should be doing it anyways!). If you set a goal for what you want to do with the $1378 you will save, you will be more inclined to follow through! It can be anything – a trip, a new couch, saving for a wedding or college education. Whatever! Just make it matter!

So will you be doing the SaveaLoonie-style 52 Week Savings Challenge this year, sticking to the original or doing something completely different? We’d love to hear about it on the SaveaLoonie Facebook Page!